At Everwood we are aware that we can contribute to economic development in a sustainable way, working through investments in optimizing the use of resources, minimizing negative social and environmental impacts and maximizing positive ones.

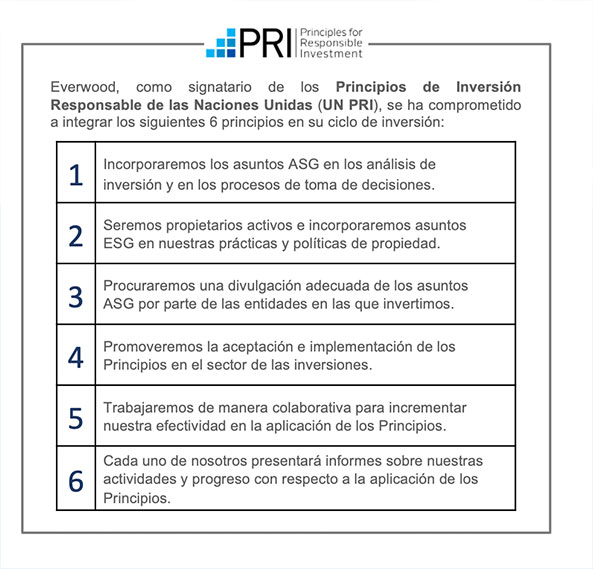

In this context, in our responsible investment policy we establish the strategy and associated practices to incorporate sustainability in our activities as a manager, also formalizing our commitment to the integration of the United Nations Principles for Responsible Investment (UN PRI) throughout the year. investment cycle.

Currently, Everwood manages two asset classes, vehicles that invest in renewable energy and vehicles that invest in SMEs with a particular focus on transport and logistics.

The ESG strategy followed in renewable funds is a positive screening strategy and the ESG strategy followed in SME funds is an engagement strategy. In both cases, a list of exclusions is also applicable that limits investments in certain sectors and is aligned with the investment criteria of the European Investment Bank (EIB).

The scope of the policy includes measures that cover the entire investment cycle, starting with the analysis prior to the investment decision, through investment management and ending with the divestment process:

Goals:

Incorporation of positive and negative investment criteria.

Evaluation of investment risks and opportunities through proprietary tools.

Actions carried out:

Investment criteria

We have a series of investment criteria that determine the sectors and activities analyzed during pre-investment. The exclusion criteria are aligned with the investment criteria of the European Investment Bank.

ESG Assessment

We evaluate the potential risks risks of each project in relation to the most relevant ESG aspects such as the environment, ethics and human rights, among others. Additionally, an analysis of the project's contribution to the SDGs is included.

With this tool, environmental, social and corporate governance factors are evaluated, as well as the management of these factors, and the impact on the SDG objectives. With all this information, a score is assigned for each project, with which a final evaluation is issued.

Based on the results of the evaluation and the identified risks, we consider the need to carry out a more detailed analysis and/or implement mitigation actions to reduce the identified risks.

Goals:

Monitoring of ESG KPIs.

ESG management of portfolio projects.

Actions carried out:

KPI monitoring

We monitor a series of ESG KPIs on a quarterly basis, based on the requirements of the SFDR and other aspects relevant to your activity.

Engagement

Engagement actions,and based on the results obtained by monitoring KPIs, we promote the integration of good ESG practices among its investees.

In accordance with the requirements of current regulations, we prepare an annual report on the performance of our investments based on the monitoring of ESG KPIs.

Goals:

Enhancement of ESG management carried out during the investment.

Active search for responsible investors.

Actions carried out:

ESG management assessment

We incorporate relevant aspects about the performance and ESG evolution of the investees throughout the divestment

process with the aim of highlighting the management that we have carried out during the previous phases.

During the divestment phase, a qualitative and quantitative evaluation of the performance achieved in terms of ESG is carried out through a vendor . due diligence.

We value the evolution of the main ESG indicators during the project's investment period

Alignment with the Sustainable Development Goals

The Sustainable Development Goals (SDG) framework is presented as a trend that has been gaining weight and relevance in terms of ESG. Everwood Capital has identified those SDGs to which it contributes the most through its investments (SDGs 7, 8, 12 and 13).

PRI

Everwood Capital has carried out the work of identifying those SDGs to which it makes the greatest contribution through its investments, being the following 6 principles in its investment cycle.

Practical Case:

The integration of ESG criteria into a new generation of renewable projects

Desafío Solar was the first new construction plant managed by Everwood Capital. With a capacity of 50 MW and a surface area of 100 Ha, the development and construction process of the plant was carried out under a complete integration of ESG criteria. On the one hand, the project followed strict environmental criteria, including an environmental monitoring plan throughout the life of the plant. On the other hand , social criteria were analyzed, promoting local employment and the economic impact in rural areas, as well as governance and good government criteria.

Practical Case Desafío Solar:

Download here

Sustainability Disclosures

Everwood Capital, SGEIC, S.A., , (hereinafter, “Everwood Capital” o “Everwood”) is subject to Regulation (EU) 2019/2088 on the disclosure of information related to sustainability in the financial services sector, ( hereinafter the “Regulations” or “SFDR”).

Everwood Capital integrates sustainability risks into its investment decisions and in compliance with its transparency obligations towards its investors and other stakeholders, the detail on the integration policy of these risks required by Article 3 of the Regulation is described in its Responsible Investment Policy.

Remuneration Policy includes information on the coherence of the remuneration system with the integration of sustainability risks, as established in article 5 of the Regulation.

Everwood Capital takes into account the Main Adverse Incidents (PIAs) on the sustainability factors of its investment decisions within the meaning of article 4.1. of the Regulation. Some of the managed vehicles include investments in companies that are in the professionalization phase and implementation of management systems that allow them to consider PIAs in their investments. The intention of the management team is to be able to consider the PIAs for all the investees as the professionalization process progresses and there is certainty about the ability to collect the reliable data necessary for their calculation by the investees.

• Statement on Principal Adverse Impacts Fund V

• Declaration of Main Adverse Incidents Fund V

• Information regarding Everwood Renewables Europe V, F. CR

• Information related to Dante Solar SCR, SA

• Information related to Medea Renovables SCR, SA

• Information related to Gala Energía SCR, SA

• Information related to Aura Fotovoltaica SCR, SA

• Information regarding Everwood Transport and Logistics I FCR

• Information related to Eral Capital SCR, SA